Digitization of Radio: What Does Audio Advertising Look Like Today?

The radio landscape has undergone dramatic changes since its introduction as an advertising platform. For so long what we knew to be audio advertising was limited to advertising on radio stations which we had little access to, aside from tuning in to the radio in our cars or homes. Today we are seeing a huge change from what was once a simple form of advertising to one with multiple branches of opportunities in terms of direct response marketing.

Why Should You Advertise on Radio?

Radio has always had a good track record signifying its potential as a great lead and revenue generator for marketers in the US and Canada. More than 76% of Canadians say radio makes their time in the car more enjoyable, and 50% of millennials tune in to radio for discovering the latest hits, according to Nielsen. It's clear that the medium is still a powerful tool for maximizing a marketer's reach, boasting a total market value of $1.6B.

When compared to other formats, radio advertising is very cost effective and stable. For one thing, drop off rates are very little with radio since it offers coverage throughout the year and impressions don't experience seasonal fluctuations. In addition, radio advertising costs are relevantly low when it comes to production and faces less deadline delays than other advertising mediums.

Radio Media Buying

The process of getting an ad on radio is quite simple and bears similarities to a TV media buy. However, a few details separate the two such as the marketer's specific needs and resources, as well as the product or service itself. The first step is for marketers to meet with a radio media buyer to outline their budget, describe their product and desired target market. Using audience data from various outlets like Numeris, Radius or their own historic performance data, media buyers come up with the audience pool that would most match the marketer's needs. They would also know which stations rank highest for a certain market sector or desired time slot.

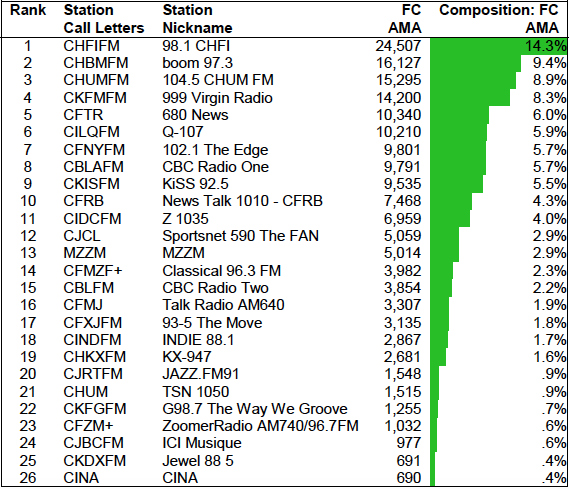

For example, in Canada 98.1 CHFI ranks highest among individuals aged 18-49, with 24,507 listeners per minute on average. Other popular stations include boom 97.3 and 104.5 CHUM FM, as seen in the table below. So, if a marketer is hoping to target that consumer age group, the stations outlined in the table below would be their top choices. While national DR clients use response as a primary KPI to indicate success, we guide our buying decision through looking at full coverage Average Minute Audience (AMAs) or Gross Rating Points (GRPs) to identify opportunity.

(Source: Numeris, A1849, R4.2017, All Week)

After a list of the appropriate stations is compiled and reviewed by the marketer, media buyers then purchase time on a station's schedule. The spot is first ran as a test for two to four weeks before it's time to optimize; alter the schedule, up the spend on stations that are doing well and decreasing the budget for another station or eliminating it altogether if it is not hitting the marketing objective.

Performance of a radio campaign is measured in a variety of ways, depending on the call to action used in the advertisement. Most commonly with direct response radio, a radio station is assigned a unique promo code or URL– "Just go to wayfair.ca and enter promo code 9595 to save..."– which allows customers to access the special offer at the marketer's website while allowing for individual station performance analysis on the tracking side. Other calls to action involve making a phonecall to an 800 number, which is also a good way of separating radio traffic from TV or online traffic when it comes to tracking.

How Much Does Advertising on Radio Cost?

While it may seem like a very simple question, truly putting a single price on advertising on the radio is quite difficult. This is because many factors interplay when it comes to how much the overall ad spend can be. For one thing, our media buying agencies has deals with networks across the country that allow them to have their own pre-determined set of prices. In addition, pricing depends on the stations where you buy media as well as the time of day the advertisement is ran. Looking at the table above, it goes without saying that a spot ran on 99.9 Virgin Radio would cost a little more than if it were to be ran on INDIE 88.1. This is not discouraged at all; marketers can still reach their target audience, only the market size would be smaller. To put things in perspective, a typical test radio advertising campaign which runs for two to four weeks costs between $5,000 and $15,000. When choosing to go on radio for longer, some marketers could spend more than $50,000 per week to air their spot on multiple stations across the country, usually throughout the entire day (breakfast till evening).

What About Digital Audio?

We like to think of digital audio as a complement to radio, not its opponent or competitor. Digital audio encompasses radio apps like iHeartRadio, and music streaming services like Spotify, Pandora, Soundcloud and others. These apps are global but provide the option of geotargeting Canada or the US accordingly. This is the strong selling point about these apps; the ability to refine your audience a little bit more than radio, since these apps usually have a more detailed insight into their audience on an individual level. This is a great way to capitalize on an existing user's usual habit of listening to the radio in the car on their drive to work, then using Spotify or iHeartRadio while they're at work or at home. In the same way social media complements TV campaigns, audio apps complement radio ads.

The digital audio field, aside from streaming apps, is still underdeveloped when it comes to ad space inventory. For example, while podcasts certainly are taking over as a popular form of digital audio, advertising through them is quite a challenge. There is opportunity with podcasts but the challenge lies within delivering the ad itself if the ad is to be read by the host, who is recording a podcast from a different country. Podcast advertising is not very big in Canada as a lot of the top-rated podcasts in Canada come from the United States. Podcasts like Locked on Raptors and Canadaland receive a good amount of impressions per week in Canada and could have potential for advertisers, but the Canadian podcast inventory remains underdeveloped to truly drive significant results.

Radio remains a strong advertising contender that allows for marketing at a wide reach. Kingstar Media has worked with numerous products, big or small, to achieve several different marketing objectives and drive measurable results. Our experience with brands of different industries–from Silk'n and SkipTheDishes, to Credit Karma, ZipRecruiter and Vistaprint–leads us to have concrete evidence in radio's power to drive sales and widen reach. The audio advertising world is expanding and changing, but radio is not being replaced any time soon. It remains a primary advertising source offering mass reach at a cost efficient rate.

Interested in advertising on the radio with us? Contact us today to get started!